Proven framework to improve EBITDA 100-300% in PE-backed middle-market companies through operations, sales, and finance optimization.

Smart Cost Management for Business Success

Why traditional budgets fail and what works instead. A smarter approach to cost management that prevents overhead bloat as you scale.

Controlling costs is paramount for maintaining efficiency and preventing overhead bloat as your business scales. During growth, you accumulate people, resources, and expenses. While budgets are a common tool used to manage costs, they often come with their own set of challenges.

The Pitfalls of Budgets

Budgets, while well-intentioned, can sometimes do more harm than good. Here’s why:

- Rigid Rules: Budgets are often seen as rigid rules that must be followed, which can lead to problems when adhered to too strictly.

- Decision-Making: Budgets can place decision-making power in the hands of individuals who may not be best equipped to make those decisions.

- Internal Game Theory: Budgets can inadvertently create game theory dynamics within the company as teams vie for their share of the budget.

- Time-Consuming: The budgeting process consumes valuable time during planning, requesting, and defending cycles.

- Wasteful Spending: Budgets can encourage maximum spending, even when it’s not necessary, leading to wasted resources.

A Better Approach: Cash Flow Modeling

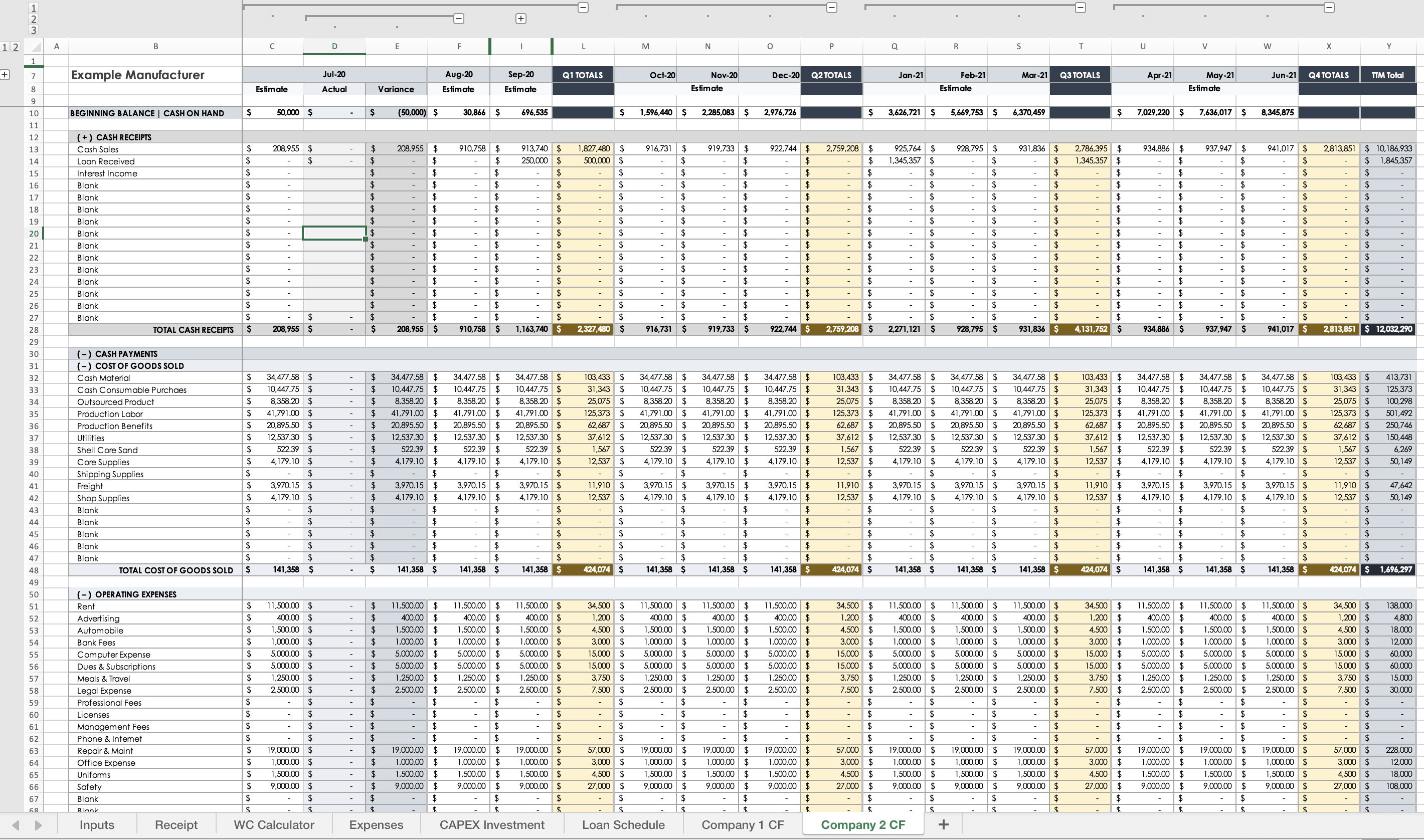

To avoid these pitfalls and maintain responsible spending, consider implementing a cash flow modeling system. Here’s a quick and effective method:

-

Create a 12-Month Cash Flow Model: Break it down into quarters for better granularity.

-

Monthly Columns: For each month, have three columns:

- Estimate: Your projected expenses for the month.

- Actual: The actual expenses incurred.

- Variance: The difference between the estimate and actual.

-

Build Based on Assumptions: Use current run rates, planned investments, and working capital assumptions to construct the model.

-

Monthly Reconciliation: At the end of each month, add the actual expenses next to the calculated estimates.

-

Review Variances: Conduct meetings with each department or company division where variances are significant, whether above or below the estimate.

-

Adjust and Plan: Based on these discussions, make necessary adjustments to the model moving forward.

Constant Benchmarking and Strategic Initiatives

By following this method, you establish a benchmark that you continually compare your company’s performance to. This approach also allows for planned initiatives and discussions, including:

- Cost Cutting: Identifying areas where costs can be reduced without compromising quality.

- Vendor Consolidation: Evaluating opportunities to consolidate vendors for cost savings.

- Plant or Company Comparisons: Assessing the performance of different branches or facilities.

- Investment Progress: Tracking the progress of planned investments and their impact on the bottom line.

Embrace this method as a means to consistently assess your company’s spend, ensure costs are in check, and maintain financial agility as you navigate the path of growth.

Remember, it’s not just about adhering to a budget; it’s about smart and strategic financial management that leads to sustainable growth.

Continue reading: Dive deeper with How to Improve EBITDA, Eliminating Waste, Maximizing Revenue, and Spend Analysis Basics.

Every percentage point of waste eliminated adds 0.5-1.5% to margins. Learn where waste hides and how to eliminate it systematically.

Most businesses can't answer 'where does our money go?' precisely. Monthly spend analysis by category and vendor reveals hidden savings.