Optimize your business capacity without adding headcount. Learn how to identify bottlenecks, measure throughput, and scale operations profitably.

Resource Allocation Strategies for Growth

When should you hire, buy equipment, or invest in tools? A smarter resource allocation strategy than just throwing money at growth.

Are you struggling with when to invest in essential resources—vehicles, employees, equipment, or tools? The decisions you make can significantly impact your trajectory. Luckily, there’s a smarter strategy than reflexively throwing money at every constraint.

The Conventional Approach (And Why It Fails)

When existing resources reach their limits, the instinct is to hire more staff or buy more equipment. This approach has three major pitfalls:

1. It ignores efficiency. You might be operating at 60% of theoretical capacity due to process waste, poor scheduling, or misaligned incentives. Adding resources before fixing efficiency just multiplies your waste.

2. It’s expensive to reverse. Equipment purchases depreciate. Employees are difficult to let go. If you misjudged the demand curve, you’re stuck with overhead that drags on margins.

3. It masks the real problem. Sometimes the constraint isn’t capacity—it’s sales. Or quality. Or cash flow timing. Adding resources to a sales problem just makes your losses larger.

Before adding resources, always ask: are we getting maximum value from what we already have?

The Resource Allocation Framework

Here’s the three-step approach I use with every company I work with.

Step 1: Identify and Categorize Key Resources

Not all resources are created equal. Categorize them by how quickly you can add or remove them:

| Category | Time to Add | Time to Remove | Examples |

|---|---|---|---|

| Flex | Days-weeks | Days | Temp workers, contractors, overtime |

| Medium | Weeks-months | Weeks-months | Full-time hires, vehicles, equipment |

| Fixed | Months-years | Years | Facilities, major capital equipment |

The key insight: always exhaust flex resources before committing to medium or fixed resources. Overtime is expensive per hour but cheap to eliminate. A new hire is cheap per hour but expensive to eliminate.

Step 2: Set Resource-to-Revenue Targets

Define target allocation levels as a percentage of revenue. Create bands around these targets:

For example:

- Green zone (optimal): Labor at 25-30% of revenue

- Yellow zone (monitor): Labor at 30-35% of revenue

- Red zone (investigate): Labor above 35% of revenue

These benchmarks vary by industry, but the principle is constant: every resource should have a target relationship to revenue.

Step 3: Monthly Resource-to-Revenue Analysis

This is where the magic happens. Every month, evaluate your key resources’ performance relative to revenue.

Scenario A: Resource utilization drops while sales increase. This is good. It means your increased sales are justifying the existing investment. You’re getting leverage on your resources. Keep going.

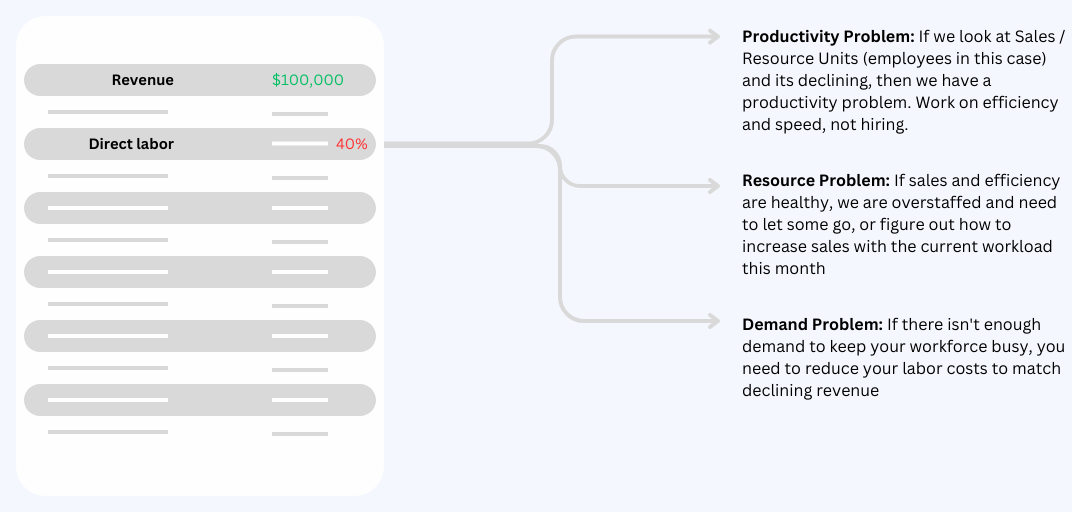

Scenario B: Resource allocation is high but sales aren’t growing. This is a warning sign. You have two possible root causes:

-

Productivity Problem: Investigate inefficiencies. Are resources optimally utilized? Are there workflow bottlenecks? Is equipment breaking down? Is scheduling sloppy?

-

Demand Problem: Shifts in market trends or customer behavior are impacting sales, not your resource allocation. No amount of operational efficiency will fix a demand problem.

The diagnosis matters because the solutions are completely different. A productivity problem needs process improvement. A demand problem needs sales and marketing.

Capital vs. Operational Resources

A common mistake: treating capital purchases (equipment, vehicles) the same as operational resources (people, supplies).

Capital resources:

- Large upfront cost

- Long payback period (2-5+ years)

- Difficult to reverse

- Creates fixed overhead

Operational resources:

- Ongoing cost

- Short payback expectation (months)

- Easier to flex

- Variable with volume

The rule: Fund capital from profits or long-term financing. Never stretch cash flow for capital purchases. If you can’t afford the equipment without straining cash, you’re not ready for it.

The Decision Matrix

When facing a resource decision, run it through this matrix:

| Question | Yes → Proceed | No → Stop |

|---|---|---|

| Are existing resources fully utilized (>85%)? | ✓ | Optimize first |

| Is the demand proven (not projected)? | ✓ | Wait for evidence |

| Can we absorb this cost for 6 months if sales don’t grow? | ✓ | Reduce scope |

| Have we exhausted flex resources (overtime, contractors)? | ✓ | Use flex first |

| Is there a path to remove this resource if needed? | ✓ | Reconsider |

All five should be “yes” before committing to medium or fixed resources.

Industry Benchmarks

Here are typical resource-to-revenue targets I see in healthy companies:

| Industry | Labor % of Revenue | Equipment/Capital % |

|---|---|---|

| Distribution | 18-25% | 3-5% |

| Manufacturing | 20-30% | 8-12% |

| Home Services | 25-35% | 5-8% |

| Professional Services | 45-55% | 1-3% |

Note: These are gross revenue percentages. Your specific targets depend on your margins, pricing, and operational model.

Four Real Examples

Distribution Company: Was planning to hire 3 warehouse workers. We analyzed the operation and found 40% of labor time was spent walking to pick locations due to poor slotting. Re-slotted the warehouse (2-week project) and delayed hiring by 6 months.

Manufacturing Company: Wanted to buy a $400K machine to add capacity. We discovered the bottleneck was actually the paint booth downstream. A $30K exhaust upgrade increased throughput 35%. The expensive machine purchase was deferred indefinitely.

Home Services Company: Kept adding trucks and technicians but revenue per tech kept declining. The problem wasn’t capacity—it was dispatch efficiency. Implementing proper routing increased revenue 22% with the same fleet.

Professional Services Firm: Wanted to hire senior talent to take on bigger projects. We found existing senior staff was spending 40% of time on tasks that could be delegated. Created a junior team structure first, then hired senior talent only when leverage was proven.

The Bottom Line

Scaling your business requires proactive resource management, not reactive spending. Before adding resources:

- Verify existing resources are fully utilized

- Confirm demand is proven, not projected

- Exhaust flex options before committing to fixed

- Run the decision matrix

- Plan for the downside (what if sales don’t grow?)

Through clear revenue targets, resource categorization, and continuous resource-to-revenue analysis, you’ll make decisions that drive balanced and sustainable growth—rather than expensive mistakes you’ll spend years unwinding.

Related Reading:

Resources in, revenue out. Most leaders overcomplicate this. The Resource ROI Framework measures the return on every dollar and hour invested.

The productive unit is the real driver of revenue—not sales. Learn how to identify, measure, and optimize your productive units to scale profitably.